Keywords: Stablecoins, Cryptocurrency, Crypto Regulation, Digital Tokens, Financial Conduct Authority, Cryptocurrency Types

Introduction

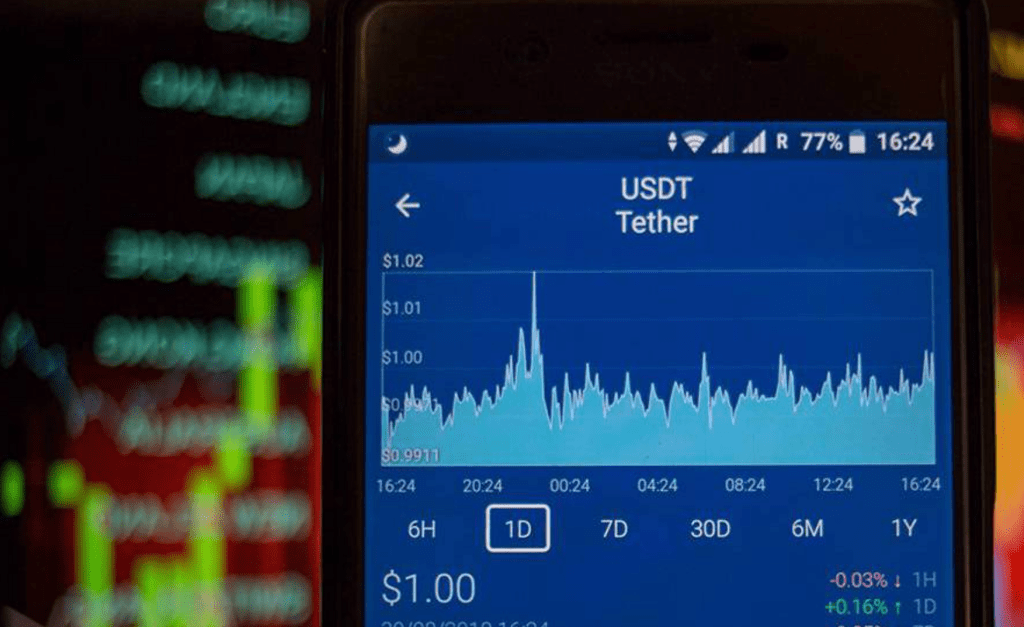

Cryptocurrencies have taken the world by storm, with various types entering the market, each with unique characteristics and functions. Among these are stablecoins, digital currencies designed to minimize price volatility by being pegged to a stable asset or group of assets. However, the question remains: just how “stable” are these stablecoins? This article seeks to examine the notion of stability within the realm of stablecoins and delve into the regulatory considerations surrounding them.

The Stability Quandary

Despite their name, not all stablecoins have lived up to the promise of stability. The British Financial Conduct Authority has even declined to refer to these digital currencies as “stablecoins,” stating that their claimed stability is largely aspirational. Indeed, the recent price volatility observed in certain stablecoins has raised doubts about their stability and viability as a dependable medium of exchange or store of value.

Types of Stablecoins and Their Stability

Stablecoins come in different shapes and sizes, each with its unique mechanism to maintain price stability. Some are backed by real-world assets, while others use algorithmic mechanisms. However, the only type considered genuinely “stable” are those representing tokenized e-money on the blockchain, fully backed by liquid off-chain financial assets with stable values.

The Regulatory Perspective

As governments and financial authorities around the world grapple with the phenomenon of cryptocurrencies, the task of effectively regulating these digital tokens becomes increasingly complex. Policymakers in regions like the European Union and the United States are actively working on drafting laws to regulate the crypto industry, taking into account the economic functions performed by various digital tokens rather than their legalistic labels.

Conclusion

Decoding the true stability of stablecoins requires a deep understanding of their underlying mechanisms and the economic functions they perform. As regulatory authorities around the world work towards bringing order to the world of cryptocurrencies, the focus should be on the economic substance rather than the nominal labels of these digital tokens.

As the crypto landscape continues to evolve, so will our understanding and interpretation of these fascinating digital assets. Your perspectives, questions, and comments on this topic are most welcome. Let’s continue this discussion in the comment section below, enhancing our collective knowledge about this dynamic world of digital currencies.