Keywords: Development Finance, Environmental Impact Bonds, Rhino Bonds, Wildlife Conservation Bond, Catastrophe Bonds, Global Environment Facility

Development finance, a field tasked with facilitating growth in the world’s most underprivileged regions, is ripe for creative solutions. This article delves into the emergence of environmentally focused bonds as innovative tools for achieving sustainable development goals.

Environmental Impact Bonds: A Case Study

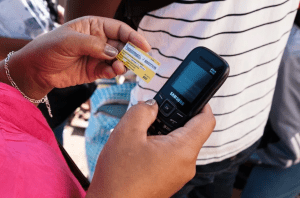

A shining example of such ingenuity is the creation of bonds aimed at preserving the environment and promoting sustainable practices. For instance, a project reducing the need to burn biomass for boiling water was funded through the issuance of a bond. It’s estimated that this project will reduce deforestation, improve air quality, lower fuel costs, and decrease greenhouse gas emissions by almost three million tons of carbon dioxide throughout the bond’s lifespan.

Rhino Bonds: Linking Finance to Conservation

Building upon this model, we can look to the “Rhino Bond” as another remarkable instance of innovative financing. This $150 million, five-year Wildlife Conservation Bond, issued by the World Bank in 2022, directly ties financial outcomes to the conservation of the highly endangered black rhino. The bond’s repayments are contingent on the growth of the rhino population, a metric independently verified and funded through a conditional grant from the Global Environment Facility.

Catastrophe Bonds: Building Resilience

The World Bank is also leveraging private capital for the welfare of developing nations via catastrophe bonds. These instruments fortify a country’s financial resilience against disasters by providing immediate funds post-calamity, thus minimizing the economic shock of such events.

Conclusion

The intersection of finance and environmental conservation presents a fertile ground for innovation, as demonstrated by the rise of environmental impact bonds. Such creative solutions hold the potential to revolutionize development finance, fostering sustainable growth and resilience in the face of climate change and environmental degradation. We welcome your thoughts and questions on this exciting development in the world of finance. Together, we can drive the conversation forward and inspire further innovation.