Keywords: Foreign Direct Investment, FDI, Multilateral Investment Guarantee Agency, MIGA, Emerging Economies, Capital Optimization, Financial Innovation

Introduction

As Foreign Direct Investment (FDI) inflows dwindle in developing nations, the Multilateral Investment Guarantee Agency (MIGA) is introducing new innovations to compensate for the decline. This article delves into the latest strategies MIGA has been implementing to foster investments in these countries despite the bleak outlook for FDI.

The State of Foreign Direct Investment

A recent report by the United Nations Conference on Trade and Development (UNCTAD) indicates a steep drop of nearly one-third in global FDI in the second quarter of 2022, with emerging regions experiencing a significant decline and Africa’s FDI inflows close to nil. The forecast for FDI in the coming year seems pessimistic.

Though FDI is considered crucial for capital formation and knowledge transfer in emerging economies, the inflow of FDI into these countries has remained relatively stagnant over the last decade, failing to match their overall economic growth rate.

Innovations by MIGA

MIGA, an agency of the World Bank Group established in 1988, remains committed to promoting investment in developing countries and has been expanding its product portfolio to address this reality. Initially focused on political risk guarantees to stimulate FDI, MIGA introduced its first alternative guarantee product in 2009 as a complement to traditional products supporting FDI, aiming to foster investment in emerging markets in new ways.

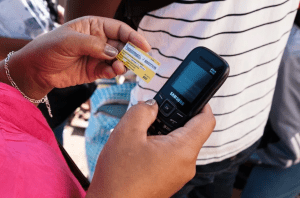

One such innovative product is the “Capital Optimization” offering, designed to protect global banks against expropriation of capital reserves held with central banks in emerging markets. This product can free up funds for new local loans to spur development in key areas, including climate finance, small and medium-sized enterprises, and female-owned businesses.

Since its introduction, the demand for the “Capital Optimization” product has grown steadily and continues to help emerging and developing economies enhance their creditworthiness and liquidity, especially during the COVID-19 pandemic.

Conclusion

As we observe the decline in FDI and its potential impact on emerging economies, MIGA’s efforts exemplify the type of innovative approach required to adapt to these challenging realities. While the short-term outlook for FDI might appear bleak, these financial innovations are a beacon of hope for continued investment in developing countries.

I encourage you, the readers, to share your thoughts on these developments. What other strategies could global finance agencies like MIGA adopt to mitigate the impact of declining FDI? Your insights are invaluable. Please leave your comments below, and let’s foster a meaningful dialogue around these crucial financial trends.