Keywords: Cryptocurrency, Sustainability, Bitcoin, Energy Consumption, ESG, Greening Cryptocurrency

Introduction

The world of cryptocurrencies has been a whirlwind of innovation and disruption. However, this digital gold rush has not been without controversy, particularly when it comes to the environmental impact. With cryptocurrencies, especially Bitcoin, being notorious for their high energy consumption, their growth could potentially jeopardize our progress towards a greener, more sustainable world. This article will delve into this pressing issue and consider how the cryptocurrency revolution can align with the principles of sustainability.

The Environmental Impact of Bitcoin

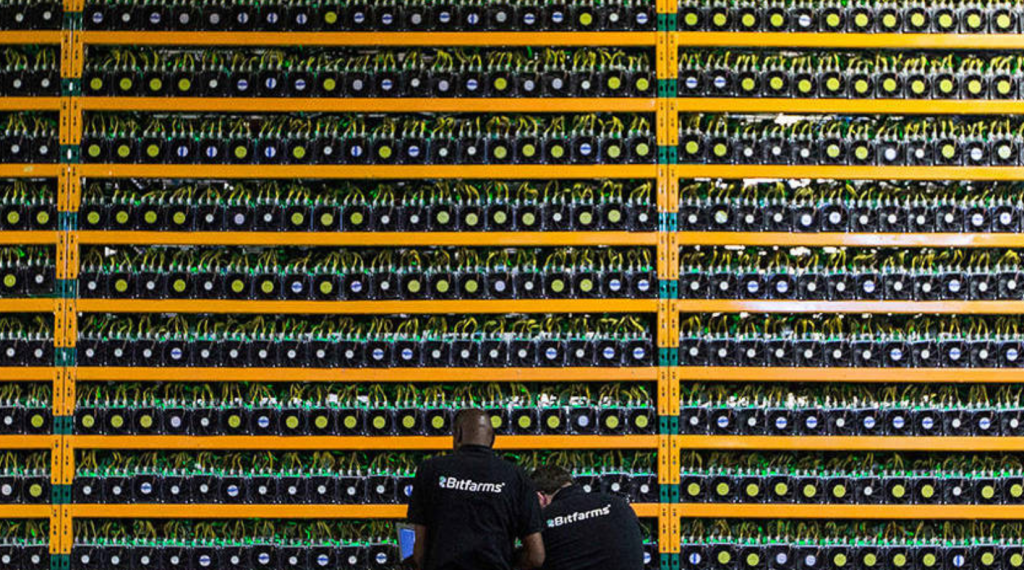

One of the main criticisms leveled at cryptocurrencies like Bitcoin is their energy-intense mining process. Tesla’s founder, Elon Musk, in May 2021, highlighted this issue, citing Bitcoin’s colossal energy usage as the reason his company would no longer accept the cryptocurrency. It’s estimated that a single Bitcoin transaction uses up more energy than nearly 1.8 billion Visa transactions.

Furthermore, studies suggest that over 70% of Bitcoin’s energy consumption stems from non-renewable sources, such as coal. From November 2018 to November 2021, as Bitcoin’s market capitalization skyrocketed from $70 billion to over $1 trillion, its annual global energy consumption quadrupled to more than 200 terawatt-hours (TWh). This pressing issue, although not extensively discussed at the COP26 conference, is a crucial concern for crypto users and policymakers.

Greening the Cryptocurrency Revolution

As awareness about the environmental footprint of cryptocurrencies grows, regulators worldwide are beginning to respond. They are developing new environmental, social, and governance (ESG) frameworks to encompass financial services, including digital assets like cryptocurrencies. For instance, in Europe, policymakers are focusing on the environmental impact of crypto assets as part of the ongoing negotiations over the proposed EU Markets in Crypto-Assets (MiCA) regulation.

This represents an important step towards integrating cryptocurrencies into the broader sustainable finance framework. While the road to greening the crypto revolution may be fraught with challenges, this ongoing regulatory effort signifies a promising start.

Conclusion

The crypto revolution is well underway, and its impact on the financial landscape is undeniable. Yet, as we harness the potential of these novel technologies, it’s imperative that we do not lose sight of the larger goal of sustainability. The challenge lies in embracing this financial innovation without compromising our commitment to a greener and more sustainable world.

I encourage you, as part of the investment community, to consider how we can reconcile the drive for digital disruption with the pressing need for sustainability. Can we truly ‘green’ the crypto revolution, or are the two fundamentally incompatible? Please share your thoughts, insights, or questions in the comments below. Let’s foster a conversation about this pressing issue, shaping the future of finance and our world.