Keywords: Cryptocurrency, Fintech, Regulation, Digital Assets, Financial Inclusion

Introduction

Financial technology, popularly known as ‘fintech’, promises to revolutionize commercial activities by making them faster, less expensive, and even accessible across international borders. A significant benefit is the potential to extend financial services to the 1.7 billion individuals globally who are currently unbanked or underbanked. However, like all technological advancements, fintech’s impact is not unilaterally positive. Amidst these developments, the emergence of digital assets, or cryptocurrencies, has generated intense debates over the need for regulation. This article seeks to explore this complex landscape where innovation intersects with regulation.

The Double-edged Sword of Cryptocurrency

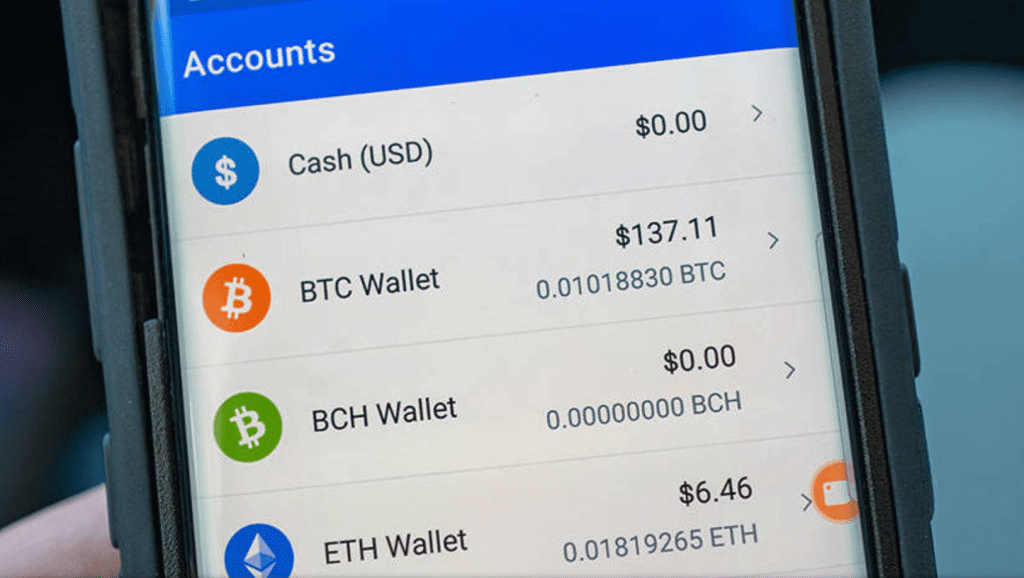

The explosion of cryptocurrencies in recent years presents a fascinating study in contrasts. On one hand, there are myriad scams that have left countless investors nursing substantial losses. Conversely, there are genuine opportunities for growth and value creation. This creates a unique predicament for governments and electorates, who must balance the potential risks and rewards of these emerging technologies.

Raghuram G. Rajan, the former governor of the Reserve Bank of India, recently shared his perspective on this issue at Project Syndicate’s “Finance 3.0” event. The essential question posed was, “Do cryptocurrencies need more regulation than traditional financial instruments?”

The Regulatory Conundrum

The question of how to regulate cryptocurrencies is far from straightforward. With cryptocurrencies’ nature, enforcing traditional regulatory frameworks may be impractical, if not impossible. Additionally, over-regulation could stifle the innovation that cryptocurrencies bring to the financial sector.

However, the absence of regulation can lead to a ‘wild west’ situation, where scams proliferate, and the public is left vulnerable. The key lies in crafting regulations that strike a delicate balance – promoting transparency, mitigating risks, while fostering innovation.

Conclusion

Navigating the “Crypto Wild West” is a complex but vital task in today’s financial landscape. The promise of fintech and digital assets is immense, but it comes with significant challenges. Governments worldwide must carefully tread the line between supporting innovation and ensuring public safety.

As we continue to explore the frontier of digital assets, a thoughtful, nuanced approach to regulation will be critical. The path forward will undoubtedly be filled with both challenges and opportunities, but with careful navigation, we can harness the potential of this new frontier for the benefit of all.

Do you have any thoughts on the regulation of cryptocurrencies? How do you believe governments should balance the risks and rewards of these new technologies? Please share your thoughts in the comments below. I welcome your questions and look forward to an enriching discussion.