Keywords: Exchange Rates, Developing Economies, World Bank, Financial Stability

Introduction: The Economics of Dual Exchange Rates

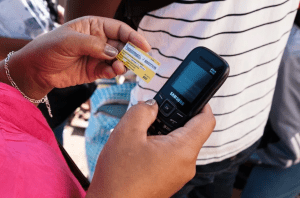

Exchange rates, in simple terms, indicate the value of one currency relative to another. However, when it comes to developing economies, this simplistic definition often gives way to a more complex structure: the dual exchange rate system. In this context, there exists an official exchange rate set by the government, and a parallel rate that arises due to market forces. As an investor, understanding the intricacies of such systems is pivotal to informed decision-making.

The Rationale behind Parallel Exchange Rates

When countries grapple with economic hardships, it’s not uncommon to witness a rising divergence between the official and parallel exchange rates. A growing trend has been observed recently in developing nations, which are increasingly inclined towards devaluing their currencies, thereby giving rise to parallel exchange markets. This phenomenon isn’t isolated but is evident in about 24 emerging and developing economies. Particularly in 14 of these countries, the exchange premium – the gap between the official and parallel rates – stands at a substantial 10%.

Impact of Parallel Exchange Rates

Parallel exchange rates create a plethora of economic implications. They tend to be costly, introduce significant market distortions, and are linked to heightened inflation rates. Additionally, they inhibit the growth of the private sector, deter foreign investments, and slow down economic expansion. On a more alarming note, these rates often fuel corruption, favoring those who can access currencies at subsidized rates, frequently to the detriment of the broader world economy, and sometimes even global institutions like the World Bank.

Typically, nations resort to a parallel exchange rate system when they confront balance of payment crises. Institutions like the International Monetary Fund (IMF) urge the implementation of corrective measures to address exchange distortions, but progress remains slow and limited in nations such as Argentina, Ethiopia, and Nigeria, where significant disparities persist.

The Path to Unified Exchange Rates

To rectify the situation, several countries have initiated the process of unifying the dual exchange rate system. However, their efforts are often hampered by the reluctance to swiftly abandon established interests that would then lose subsidies. The slow and gradual approach, even when backed by agreements with the IMF, generally doesn’t ensure the unification of the exchange market.

Conclusion: A Call for Concerted Action

The dilemma of dual exchange rates poses substantial challenges to the financial stability of developing economies. However, understanding the dynamics behind such rates can provide valuable insights for investors, policymakers, and stakeholders. Unified exchange rates can pave the way for more transparent, efficient, and growth-oriented economic landscapes, ultimately promoting the well-being of these nations.

We hope this article has shed light on the complexities of dual exchange rates and their implications on global finance. Should you have any queries or wish to delve deeper into this topic, please feel free to leave a comment or get in touch. The world of finance is an ocean of opportunities, and every ripple, every wave, is worth exploring.