Keywords: Private Capital, Infrastructure Investment, Developing Economies, Economic Challenges

Introduction: Unleashing Private Capital in Infrastructure

The global economic landscape is replete with challenges, more so for developing countries grappling with climate change, escalating debts, stubborn inflation, high interest rates, currency depreciation, conflict, and food insecurity. In the midst of this turmoil, infrastructure stands as a critical sector demanding significant financial commitment.

With the slow-paced global economic recovery and inflation rates higher than pre-pandemic levels, it has become essential for policymakers to counter these challenges with determination and urgency. This article explores the role of private capital in surmounting these challenges and directing resources towards infrastructure investment.

Harnessing Capital Flows for Sustainable Infrastructure

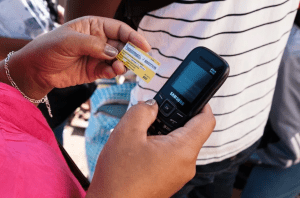

A pivotal aspect of mitigating these circumstances involves stimulating capital flows, particularly towards developing economies. More specifically, it involves channeling investments into quality, sustainable infrastructure.

Large-scale shifts are required not only in how infrastructure is constructed but also in how it is financed. The requisite improvements to infrastructure, aimed at providing basic and necessary services to billions globally, demand an annual investment equivalent to 4.5% of the GDP. Moreover, developing countries need an additional $2.4 trillion per year over the next seven years to handle costs related to climate change, conflicts, and pandemics.

Even in the best of times, it is improbable for a single entity to shoulder such massive financial burdens. Consequently, private sector participation in infrastructure investment has been prevalent for decades.

Private Sector Participation: An Undeniable Necessity

For over 30 years, the participation of private capital in infrastructure investment (PPI) has been systematically tracked. Such tracking of investment levels aids in monitoring progress and identifying opportunities. In essence, private sector involvement has proven to be indispensable in meeting the towering demand for resources.

A Collaborative Approach towards a Sustainable Future

Turning the tables on the economic challenges faced by developing countries requires a combined effort from public entities, private sector investors, and international institutions. The role of private capital in stimulating infrastructure development cannot be understated. It can potentially offer solutions to the mounting fiscal pressures on these nations, while paving the way for economic growth and stability.

Understanding the dynamics of private capital flow in infrastructure can offer valuable insights to investors, policymakers, and stakeholders alike. Your questions, thoughts, and feedback are most welcome. So, feel free to drop a comment or get in touch. In the vast realm of finance, every perspective counts, and every dialogue matters.